📎 How to Position Your Brand (& Template)

Because no one cares if you're "easier," "trusted," and "data-driven"

This week, I’m lucky enough to be attending Mutiny’s Marketing Leadership Summit at Dawn Ranch, and I can’t wait to report back on the discussions we have. And to eat s’mores! 🍫

For today’s post, I revisited and further fleshed out one of my most popular free Notion templates (over 3,100 downloads) on landing your competitive positioning. I’m dabbling a bit more in the product marketing space with this one, but then again, all brand marketing is product marketing (although not all product marketing is brand marketing). Hope you enjoy!

You’re here because you recently subscribed or signed up for one of my resources—my course waitlist on Maven, lightning lesson, or Notion templates.

If someone sent you this post and you’re not subscribed, join those people learning how to tactically advocate for brand at your company. 📬

If you’ve ever suffered through a competitive positioning or product marketing workshop where everyone keeps saying “we’re different because we’re better” without actually articulating how your company or offering is different, I see you—and this post is for you.

I’ve been in too many meetings where teams struggle to define what makes them unique beyond feature comparisons or vague superlatives (best, first, easiest, etc.). But the bigger point they miss is that positioning and differentiation exercises aren’t just about being different—they’re about being different in ways that matter to your target customers and help you find brand-market fit.

Having great product-market fit doesn’t automatically make you competitive. Uber and Lyft have virtually the same product-market fit. So do Airbnb and VRBO. So do ChatGPT and Claude. The difference is how they speak to and resonate with their audiences—the strength of their brand-market fit and how well they cultivate a connection with their audience.

Even knowing this, most companies default to highlighting table stakes features when describing what makes them unique. They claim differentiation through things every competitor already offers (Data-driven. Easier to use. Trusted.) or they focus on technical specs that aren’t actually driving usage or purchase consideration (AI-powered, anyone?). They position themselves as “the platform for X” or “the all-in-one solution” (and here’s why we really need to kill that phrase), losing sight of the fact that that effective positioning and product marketing requires clarity on who you serve and what specific value you deliver to them.

Why competitive positioning matters now

When new competitors seem to emerge daily and AI is fueling faster ship cycles and faster commoditization of feature sets, your brand’s competitive positioning is the foundation for:

Breaking through the noise when everyone sounds the same

Justifying premium pricing (especially important as budgets tighten and all SaaS gets put on the chopping block)

Creating messaging that resonates emotionally, not just rationally (and therefore more powerfully)

Making confident, informed decisions about product roadmaps and marketing campaigns

Building a moat that’s harder to replicate than features alone

Positioning work often gets delayed because it feels abstract (and thus hard to prioritize against tangible near-term metric-movers). Teams gets stuck in analysis paralysis (this shouldn’t take multiple decks and docs over months), or they lack the right framework (or leader) to show meaningful progress to leaders.

But without competitive positioning, you’ll struggle to develop effective websites, campaigns, and even product strategy.

The competitive positioning framework

My goal for this piece was to distill years of successful positioning efforts at high-growth companies into the simplest possible framework that gets to the heart of differentiation without getting lost in the weeds.

First, it forces you to think about your company in context (the same way your customers encounter you). You’ll sort and analyze three key types of competitors. Depending on your profile, you may be competing more or less with each type:

Incumbent brands who dominate market share

Emerging disruptors challenging the status quo

Complementary brands your customers already use and trust (they’re part of your ecosystem, too)

For each competitor (and yourself), you’ll break down:

Solution and benefit statements (how they communicate value)

Core differentiators that set them apart

The main business category they operate in

Position in the market (upmarket, downmarket, peer)

Side by side, you should see patterns, gaps, and opportunities that inform your own positioning strategy.

How to use this competitive positioning framework

You could approach this a thousand ways, but I think one of the most effective way to use this framework is with the classic “We help you... so you can...” format. This structure forces clarity around not just what you do, but what outcomes you deliver.

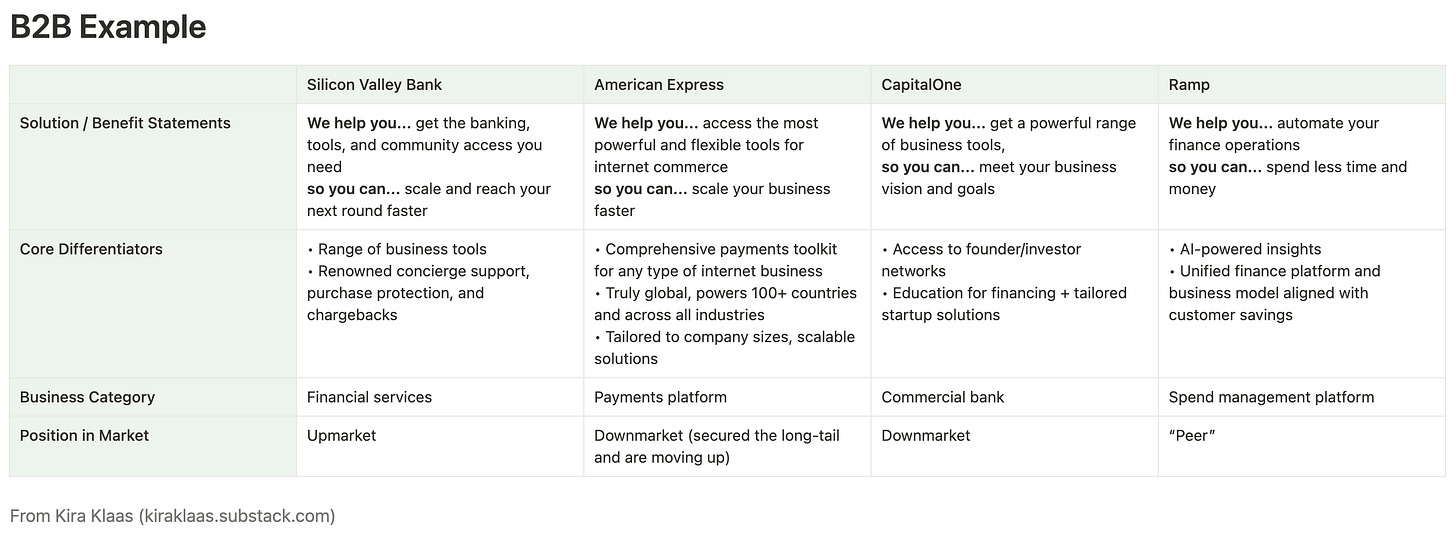

Above is a set of competitors we looked at during Brex’s early days when we were particularly comparing across business credit card offerings. Notice how each positioning statement in this B2B example above targets a slightly different customer with different priorities.

Even though they all offer business credit cards, they have distinct differentiators and benefits statements. (Layer this with a branding/creative analysis, and you’ll get a fuller picture of how these differentiators manifest in marketing and customer-facing messaging.)

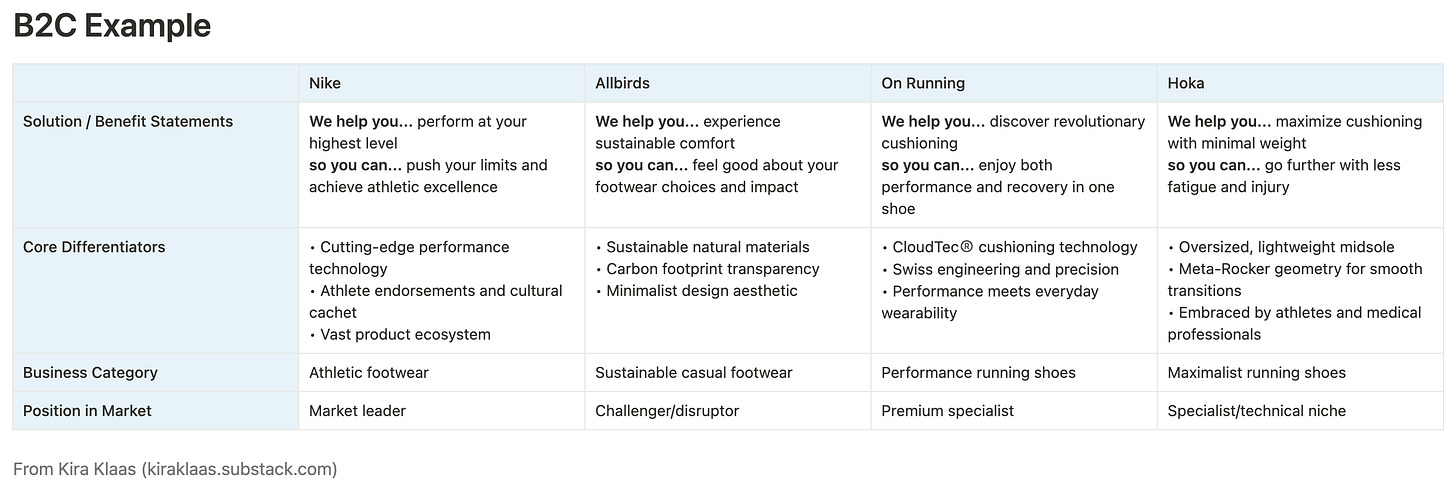

Now let’s look at a B2C example. These brands all sell athletic/running shoes, but what they’re actually selling is completely different.

Nike owns athletic excellence. They help you “perform at your highest level” so you can “push your limits and achieve athletic excellence.” They back it up with cultural cachet through celebrity athlete endorsements, cutting-edge tech, and a massive product ecosystem. As a 61-year-old brand, they’ve locked down the market leader position.

On Running, only about 15 years old, started as a “nicher” version of Nike—super performance-focused with heavy emphasis on their “Cloud” tech line and phrases like “energy return.” For the consumers where Nike was too mainstream and mass market, On spoke more to flow state and a more “spiritual” connection to movement.

But watch what’s happening now with their positioning through their new “Zone Dreamers” campaign with Zendaya.

The campaign concept still gets at the mental flow state athletes and creatives chase, but featured products are more on everyday training products rather than hardcore running gear (compare to their “The OAC: Run for each other.” spot two years ago).

“Zone Dreamers” is an extremely high production value commercial spot, and it references outer space and Star Trek (for reasons I’m still wondering about… but you know, #mainstream #quirky) to get at imagination and future possibilities, not just functional performance. They followed this spot with much more artistic collabs with LOEWE and LA-based streetwear brand PLEASURES. This is a play to help On drive category growth and support their expansion into the studio/everyday training category—which is a much larger addressable market than performance running alone. (Also, their “Soft Wins” with Elmo spot was pretty cute.)

To that end, “Zone Dreamers” is a good proof point for how On, a growing, publicly-traded company is taking the expected evolution from product brand to category brand to experience brand—and eventually global brand. It’s a push to expand beyond serious runners into the lifestyle space where global brands like Nike already play. Subscribe for my upcoming deep dive into how brands move from category to category, and what brand leaders can do to accelerate the shift.

Back to Allbirds and HOKA—while Nike and On both have sustainability talk tracks, Allbirds committed completely to this positioning with “sustainable comfort” that lets consumers “feel good about their footwear choices and impact.” Their materials and sourcing, carbon footprint transparency, and minimalist aesthetic speak to environmentally conscious consumers who want their purchases to align with their values—and the shoes have a different enough design profile that, in combination with their positioning, creates a defensible brand.

And then there’s HOKA, who still plays pretty squarely in the “product brand” space with performance-focused positioning, but differentiates functionally by emphasizing cushioning and reducing injury/physical impact (“running shoes that could be remarkably kind to the human body and still be world-class fast”). Allbirds and HOKA both talk about comfort, but HOKA’s maximalist product profile counterbalances Allbirds’ minimalist one. And that’s been enough to let them dominate a specific corner of the performance running market that competes with the likes of Nike.

Competitive positioning differences shape everything from marketing campaigns to product priorities to distribution strategies—and you can immediately get why someone would choose Allbirds over Nike, or HOKA over On, beyond price or specific product feature.

Developing your company’s positioning

Here’s how to use this framework with your team:

List out your top 3-6 competitors in the template. Push yourself to think beyond the few companies that may be discussed day to day among your team—there’s probably a broader set worth considering.

Start with the “We help you... so you can...” format to clearly articulate each company’s value proposition. This structure forces clarity between what they offer and what outcomes they deliver.

List 2-4 core differentiators that make each company unique. Focus on meaningful differences that customers actually care about rather than features (chances are those aren’t very differentiating).

Note their business category and market position to understand where they play and who they target—high, mid, lower end of the market?

Look for patterns and gaps: Where’s the white space in the market? How do value propositions evolve as companies move upmarket?

From framework to action

You’ll get the most from this framework when you use it to drive action. Understanding these factors helps you understand your competitive positioning: how you need to be different and why those differences matter to your audience. From here, you can develop:

Compelling website copy that instantly communicates your value and shapes your brand-market fit

Sales materials that highlight your true differentiators and address the most relevant objections

Product roadmaps that strengthen your unique position rather than chasing competitors or feature parity alone

Marketing campaigns that help distribute your branding

Pricing strategies that match your market’s expectations and fit strategically into the competitive landscape

Scroll to the end to open the template and duplicate it to your Notion workspace. 🍄

Thanks for reading.

Did this take resonate with you? If you liked what you read, consider:

saying hi or dropping a question in the comments!

connecting with me on LinkedIn: 👩🏼💻 Kira Klaas

sending to a friend 💌 or coworker 💬

Thank you for subscribing and supporting my work! I’ll continue to share Notion templates, like these, for paid and free subscribers:

…along with longer-form writing and perspectives like these:

As a reminder, please do not sell, repackage, or distribute any of my templates—but please do share my writing! Visit notion.so/@kira for more templates.

Looking for a deeper dive into brand strategy and marketing? Check out my courses on Maven (with 25+ Notion templates, including this one) and Reforge. Join the waitlist for updates on my next Maven cohort, Brand for Growth-Stage Leaders!