The Brand vs. Growth Myth

Challenging the concept of capital-g Growth.

This newsletter topic is pretty evergreen, but if you spend any time on LinkedIn, it seems someone’s still debating this every day: Brand or growth first? Shouldn’t we spend more on growth? In this post, I’m framing the myths in context of data so we can put this debate to bed.

Also! Last few days to sign up for my 4-week course on Maven, Brand for Growth-Stage Leaders, happening now. Enrollment closes this Sunday. You can enroll now or join the waitlist for updates. Send me a message if you have questions about joining!

You’re here because you recently subscribed or signed up for one of my resources—my course waitlist on Maven, lightning lesson, or Notion templates.

If someone sent you this post and you’re not subscribed, join those people learning how to tactically advocate for brand at your company. 📬

If you’ve spent any time in startups, or on a marketing team, you may have picked up on tension between brand and growth goals and Brand and Growth teams. As I’ve covered at length in this newsletter, Brand is often misunderstood and misdeployed by founders and startup executives, while Growth is a primary focus (though I’ll argue it’s also deeply misunderstood—a label we’ll apparently throw on anything, as long as it’s not creative/emotional 🤧).

Brand is often seen as a cost-center and Growth as a revenue-driver. If this were remotely true, then leaders would be well-justified in focusing investment on growth initiatives. But it’s not true, and this way of thinking is leading to investment decisions (budgets, hiring, prioritization) that hurt company growth goals.

Before I get into why, I think it’s necessary to take this a step further and challenge the concept of capital-g Growth, an umbrella term denoting ownership of metrics goals associated with customer acquisition, activation, engagement, and retention. In some cases, Growth implies decision-making ownership of the surfaces and communications methods used to reach these goals, usually by a team called “Growth Product” or “Growth Marketing.”

We delegate these goals to “Growth” teams as if they aren’t the entire purpose of the whole company. Creating new offerings, delivering positive outcomes, ensuring great customer service—is anyone arguing these aren’t efforts aimed at growth? (If I dare question it, why not be more specific and call “Growth” teams something like Distribution teams or Traction teams? Maybe this wouldn’t be an issue if these myths didn’t exist.)

What about building a strong brand? Do you believe that strong brand awareness and positive sentiment contribute less to long-term growth than this month’s digital campaign performance? I hope not.

It’s time to end the tension, bust some myths, and recognize that brand does not stand in opposition to growth—brand is synonymous with growth.

Myth #1: Brand and Growth are mutually exclusive strategies.

Most companies with mature marketing organizations have separate Brand and Growth teams (along with Product Marketing, and sometimes Content or other orgs spun off separately). Each team has their own goals (theoretically laddering up to top-line corporate targets) that often are not directly aligned.

A good example is the company homepage—a primary brand surface that often powers acquisition. A Growth team’s goal might be “Increase homepage conversion rate from 2% to 3%” while a Brand team’s might be “Redesign the homepage to better communicate the company’s new brand positioning and visual identity.” These goals may not be in direct conflict at the outset, but could easily arrive at that point, and if they do, how do resourcing and investment decisions get made? Usually a senior leader ends up making the call, and, more often than not, the investment goes to the Growth team.

Why does Growth so often “win” investment over Brand? There are a handful of reasons—but it mostly comes back to:

Leadership misconception of what brand is (send them these two posts: 10 Brand Rules for Founders and What Do We Mean by “Brand”?)

Focus on near-term, granularly measurable outcomes

Shipping the org chart

Founders want results today. They may say “it’s a marathon, not a sprint,” but most don’t put their literal money where their mouth is. As such, marketing orgs are usually organized around delivering on short-term metrics. Add in the fact that tenures in tech are relatively short and, especially in the current rate environment, investor pressure is high, and you have a recipe for impatience and an incentive to maximize immediately measurable short term gains.

Brand building, like relationship building, takes time—its ROI isn’t as immediately, granularly measurable. But remind me, what assets and messages are being used in growth campaigns? What’s on the homepage the growth team is trying to optimize?

Growth tactics can’t grow a company’s brand. But brand is the fuel for all growth engines.

This is the core principle of brand-led growth (BLG), which I’ve previously defined as:

Brand-Led Growth: A proactive strategy that prioritizes building and leveraging a strong brand identity, values, and emotional connection with customers to drive business expansion, customer acquisition, and retention. (See also: Brand-Market Fit)

We know early startup teams can build successful growth loops (PLG and all that), often simply by having a brand synonymous with their product and using tried and tested communication techniques. Sometimes this phase can last for a long time. But it always ends—such tactics have been proven insufficient for long-term, sustainable growth and they too, hit ceilings. I’ve said it in every post so far and I’ll say it again here—it’s never too early to invest in your brand, and the more proactive you are, the longer you have for its effects to compound.

Lately I’ve been hearing the term “zombie startups” a lot—companies that have raised a lot of money, and in many cases shown strong revenue, but have hit growth rate ceilings that leave them overvalued and struggling to find an exit that rewards shareholders. These companies probably have similar attributes—great product, inspiring founders, proven Growth leaders, a brand that didn’t receive the investment necessary to communicate value and unlock new audiences. Tech companies have to grow by acquiring new customers and retaining/monetizing existing audiences. Early and proactive brand investment is the key that helps you “cross the chasm” to new audiences and strengthen retention and price sensitivity (more on this below).

Calm

We see it all the time—startups trying to use Growth tactics and channels to attract a new audience when their brand hasn’t yet built the foundation to attract that new audience. Consumer app Calm recently launched a new content series called “Moments That Matter,” part of their goal to shift gears into B2B and monetize corporate customers. As an end user, I’d open my Calm app at 10:30pm, ready to wind down, and right away see a “meditation” on “Delivering Difficult Feedback” or “Working with Difficult Stakeholders.” 💀 Serve me that content between 8am and 6pm, and not when I’m looking for a Sleep Story or my crickets soundscape.

To me, it’s transparent that this UX choice was driven by a growth goal to drive awareness of and engagement with this new content, ultimately so that Calm can better monetize B2B audiences. But the approach made my experience worse—by prioritizing growth goals alone, they didn’t consider the end user’s needs or state of mind. Now, as someone who could influence my company to adopt Calm team-wide, I’m not sure I’d want to.

Just take a look at Calm’s B2B landing page, in contrast to Headspace’s:

Headspace

“Reimagine how people experience mental wellness”—oh, so now someone gets to be in control of how other people experience their own mental health? So that we can “increase workplace productivity” since that’s the real end game here? Yikes, dude.

Now take “Mental healthcare for every moment.” Which one feels more empathetic and more tangible to you? It’s no question for me.

Headspace’s brand-led approach goes a lot further with their “for business” landing page: they focus on evidence-based outcomes (proof points to support brand claims) and build trust by showcasing the experts they partnered with to build this program.

Calm’s growth tactics pretty much ignore brand principles and go hard on literal corporate-speak (“your mental wellness initiatives”), and the result is far less compelling.

So let’s put this myth to bed. Don’t think brand stops playing a role when you shift from brand campaign down to conversion page. Brand and Growth are complementary approaches to sustainable business success that work best when intentionally integrated.

Myth #2: Startups should be investing more money and resources in growth efforts than brand building.

We’ve established that growth engines perform far better in service of a strong brand, but the question of where to invest today’s dollars remains. Even leaders who embrace brand investment often believe that growth/performance channels are where the bulk of a marketing budget should be spent. For a lot of my career, I went along with this because I assumed more senior decision makers had data-backed rationale. But a recent conversation with a friend, Alissa Reiter (former CMO, former VP Brand Marketing at Zillow), helped surface better data on marketing investment ROI.

Les Binet and Peter Field, longtime marketing effectiveness researchers, led two studies—“The Long and the Short of It: Balancing Short and Long-Term Marketing Strategies” and “Effectiveness in Context: A Manual for Brand Building”—that are particularly illuminating. The former is the study Alissa’s team at Zillow (Trulia) used to advocate for brand investment—and a more effective split overall—across their marketing campaigns.

The study’s headline takeaway is their recommendation for marketing budget allocations: Spend 62% of budget on brand, and 38% on growth. The most effective (profitable) and efficient (ROI-positive) campaigns deploy long-term brand building alongside short-term activation (whether that’s acquisition, retention, etc.).

This isn’t conjecture—it’s backed by data from nearly 1,000 campaigns across various industries. And to me, it makes intuitive sense—ensuring that your branding presses the right emotional buttons (those that inspire consideration, purchase, and retention) is the most important investment a company makes beyond product technical functionality (and probably legal compliance). If your audience is aware of you and is positively disposed towards consideration, tactical growth efforts will be much smoother and higher ROI.

And this isn’t an argument for brand over activation, but for finding the balance. “Efficiency appears to more than double with the balance in the right range. Too little brand activity and the brand equity needed to drive sales in future will not accumulate. Too little activation activity and the brand will not be exploiting the full sales potential of brand equity as it accumulates” (pg. 39).

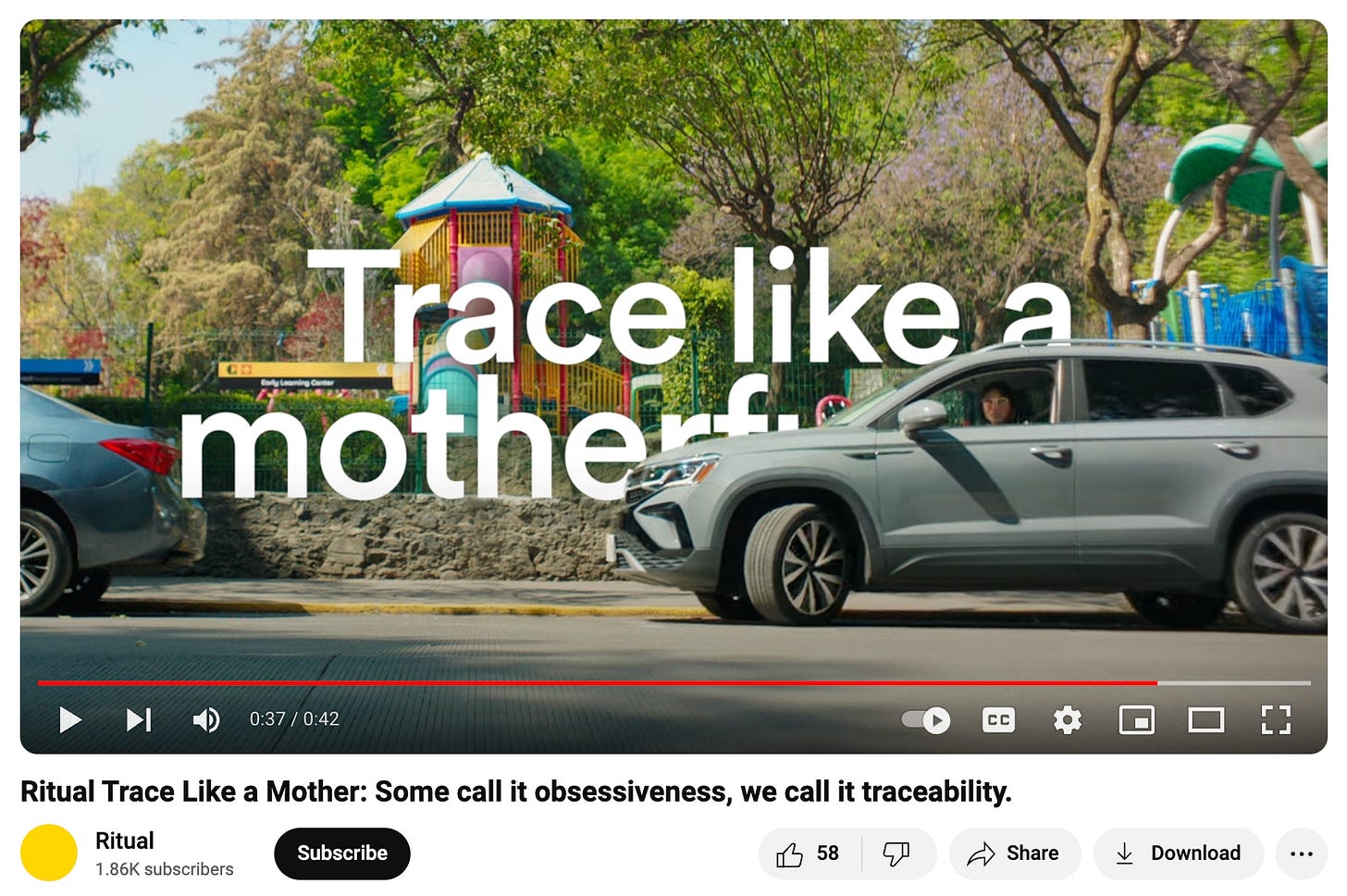

Ritual

Ritual has done an exceptional job balancing activation activity with brand equity building (and balancing “rational” and “emotional” messages as I’ll get into in Myth #3). Take their brand campaign “Trace Like a Mother” launched a few months ago, followed by seasonally timed sales like 40% off over Labor Day Weekend. If I’m emotionally primed by “Trace Like a Mother” (key message: Ritual has high standards for ingredient origin and tracing, and is trusted by diligent, relatable working moms), the study above suggests that I’m somewhere around twice as likely to act when I later get served an activation ad.

Myth #3: Features and value props are more compelling to customers than a brand’s emotional resonance.

Emotion is a topic startup teams love to avoid. Mention the word and you’re likely greeted with eye rolls and exasperated sighs—“People need to know about this amazing feature that’s coming out. How will we get new users if we don’t tell them?” or “This campaign should focus on our key value props. That’s what people are shopping for.”

Fair. There’s a time and place to invest in so-called “rational” marketing—campaigns that focus on promotional pillars and value props like functionality, price, variety, speed, ease, saved time, “AI-powered,” and so on. That time is not all the time. That place is not every channel.

Because guess what the research actually shows? “Emotional” marketing works better than “rational” marketing over the long term. (Those words definitely need a rebrand.) In contrast to promotional pillars, emotional marketing leads with brand-building pillars that might focus on identity, relationships, status, self-esteem, or values (not value props). Emotion-focused brand campaigns produce stronger business effects over time, especially on metrics like profitability and reduced price sensitivity. Binet and Field write, “emotional priming appears to impact most powerfully on longer-term effects: pricing and loyalty effects are both doubled, whereas sales and share effects are marginally increased, and new customer acquisition hardly at all.” I’m pretty sure every founder wants customers who stick around for a long time and accept higher prices.

I won’t ignore the “new customer acquisition hardly at all” piece—what this says to me is that rational messages distributed via Growth-owned channels are necessary for that specific goal. But emotional campaigns create the awareness and consideration that growth campaigns need if they want to convert.

Said another way, brand building makes growth tactics more effective by priming consumers to be receptive to short-term messages. Excited to announce your latest s-tier feature that you’ve convinced will drive tons of signups? You’d better hope your prospect has a great impression of you already. Raising prices and hoping to avoid too much churn? Hope you’ve built a strong brand foundation and delivered on your brand promises.

In fact, the research goes so far to show that “rational consideration actually inhibits the effects of advertising. The more people think about the purchase, the less influence advertising has over them” (pg. 16).

Don’t make your prospects and customers think too much about technical concepts and product details. Teach them to love everything your brand stands for. Show them the payoff of embracing your brand. Make them part of your brand journey (yes, prospects are on your journey with you—think of all the employees who use Brex cards at work who may become founders in the future).

Myth #4: You can’t measure the ROI of brand marketing, so it’s not worth the investment.

I totally get the obsession with measurement in profit-seeking businesses. Late-stage capitalism is built on metrics, and no matter how you feel about “the system” some corporate entity is probably paying your bills. If you aren’t predicting performance, measuring it, learning from your measurement and using your learnings to improve, you probably aren’t delivering the best outcomes possible.

We’ve made up the idea that “brand metrics are harder to measure than growth metrics” because we’ve arbitrarily separated acquisition, retention, and activation outcomes from the role the brand plays on them. As for company-level metrics like awareness and familiarity, it’s true that they evolve on a longer time horizon. I tend to rely on a combination of channel-specific metrics, proxy metrics (e.g. impressions, traffic), tracking survey results, and social listening or sentiment analysis, which all serve as inputs into decision making. Then we don’t just evaluate success by looking at isolated data (e.g. conversion rate), but by considering these signals in context of what we’re trying to achieve and the larger competitive landscape (data isn’t meaningful without context—and this is where taste comes in). Ultimately, the value of brand investment manifests in increased customer loyalty, reduced price sensitivity, and sustained growth over time—I’ve already covered this in the myths above; if you aren’t convinced that brand investment will have ROI for your company, let’s talk.

For many founders, who are often highly analytical, rational personalities, if you don’t have metrics at the Friday meeting, you don’t have a case for investment. And that’s the mistake. You have to trust that brand investments will pay dividends, which means you need to trust the people leading brand efforts. And if the only way they can earn your trust is by bringing dashboards showing metrics growth week to week, you’ll be stuck in a catch-22.

Brand operators can build trust in other ways, by showing, not telling. Search sales and support call transcripts for “I love”—I bet you’ll find a bunch of positive, emotional anecdotes about your brand. Bring your founders to community events. Make sure they’re talking to real customers and ICP individuals regularly. Put them in touch with leaders at other companies that you know have invested in brand.

Of course, brand teams need to be versed in metrics, to make sure awareness tracking surveys (subscribe for a future breakdown on brand trackers) are set up and that you’re deriving consideration proxies—your Growth (and data science) partners will probably be super helpful here! No metrics isn’t sustainable nor is it smart—they are key inputs for investment decisions. But it takes recognizing the role brand plays in the success (or failure) of “growth-owned” metrics, and recognizing that while their missions are shared (both to drive company growth), brand’s mission is longer-term. Consider your ROI accordingly. 🪐

My 4-week course on Maven, Brand for Growth-Stage Leaders, takes a hyper-tactical approach to leading brand in growth-obsessed environments. Enrollment for the current cohort closes Sunday. You can enroll now or join the waitlist for updates.

What brand/growth myths should we bust next? What do you think needs to change about the dialogue overall?

If you liked what you read, consider:

saying hi or dropping a question in the comments!

connecting with me on LinkedIn: 👩🏼💻 Kira Klaas

sending to a friend 💌 or coworker 💬

Swap your Calm for Waking Up! You'll never go back to any of those Headspace-like apps.