💲 How to Explain Brand to Finance

Why brand building is the compound interest strategy for growth

My Tuesday evening was well-spent at a Superside community event in San Francisco, surrounded by creative directors and marketing leaders who I’d guess all wrestle with the same challenge: how to quantify the long-term value of brand investments.

Almost ten years old, Superside is seemingly everywhere right now, following a January 2025 rebrand that helped them skillfully position themselves as the creative partner for tech that helps in-house brand teams scale. Their recent surge in popularity is a testament to how brand investments add up over time—and take time to build—and got me thinking that it was time I hammer out the brand-as-compound-interest concept that’s been swirling in my head the last few months. Can’t wait to hear your take!

You’re here because you recently subscribed or signed up for one of my resources—my course waitlist on Maven, lightning lesson, or Notion templates.

If someone sent you this post and you’re not subscribed, join those people learning how to tactically advocate for brand at your company. 📬

Most founders and execs pride themselves on financial acumen. They understand investment principles and how compound interest builds wealth over time. Yet when it comes to brand building, these leaders rarely apply similar thinking.

If you’ve tried explaining brand value to your leadership team, chances are you’ve hit a wall at some point. Many brand investments don’t calculate as immediately into the spreadsheets and quarterly reports that drive short-term business and budgeting decisions.

This disconnect explains why so many startups underinvest in brand, then pay the price. Too many fail to establish a centralized brand function or hire integrated marketing leadership until they’re lagging the market. Marketing becomes a collection of channels and random activities without strategic foundation. Hate that for you!

It’s true, though—teams speak different languages at work. As a brand leader, in one of your company’s most cross-functional roles, it’s helpful to be able to speak all the languages of different stakeholders, especially that of revenue and finance. Historically, brand hasn’t had a perfect translation, so here’s my take on how to talk shop with even the most dollars-driven stakeholders in your org.

How brand investments compound

The compound interest metaphor, which I first wrote about in the 10 Brand Rules for Founders, is a really good one for explaining why strategic brand building works.

So why is brand like compound interest? Brand building is your long-term investment strategy. It builds equity over time, gets more efficient as it grows, and your risk lowers the longer the time horizon. Performance marketing, on the other hand, is more like day trading. You might see immediate outcomes, but it usually takes higher upfront costs, requires constant reinvestment, and most eventually see diminishing returns without a big change in strategy.

Consistent small investments add up

Regular deposits into a high-yield savings account grow slowly over time. Consistent brand-building efforts—manifesting as hundreds of macro and micro brand touch points—add up to something substantial. Every interaction your audience has contributes to your brand, for better or for worse (so make it good on purpose).

These individual “deposits” could feel insignificant in the day to day if you’re used to thinking about brand only in terms of billboards on 101 and six- or seven-figure tentpole campaigns, but they’re contributing the way dividend reinvestment grows a portfolio…

Growth accelerates over time

...and with compound interest, you earn returns not just on your initial investment, but also on the accumulated gains over time. Brand equity works similarly. As your brand gets stronger, each new brand-building effort gets more effective, carrying more meaning and significance to your audience.

This is why rebranding is such a consequential decision! When companies rebrand, they’re essentially liquidating part of their accumulated brand equity and reinvesting it elsewhere. They’re making a calculated bet that redirecting their brand capital will generate greater returns in new markets or with new audiences.

Your brand equity overall makes new marketing initiatives more impactful and cost-effective. A strong brand creates a flywheel effect where each marketing dollar generates increasingly higher returns over time.

Early start maximizes returns

The earlier you start saving, the more time your money has to grow. I cannot stress this enough—the same is true for brand building. Companies that invest in their brand early have a huge advantage. They have more time to build recognition, trust, and loyalty. and If you wait until you “need” strong brand recognition, you’ll pay a premium for it.

Withstands market fluctuations

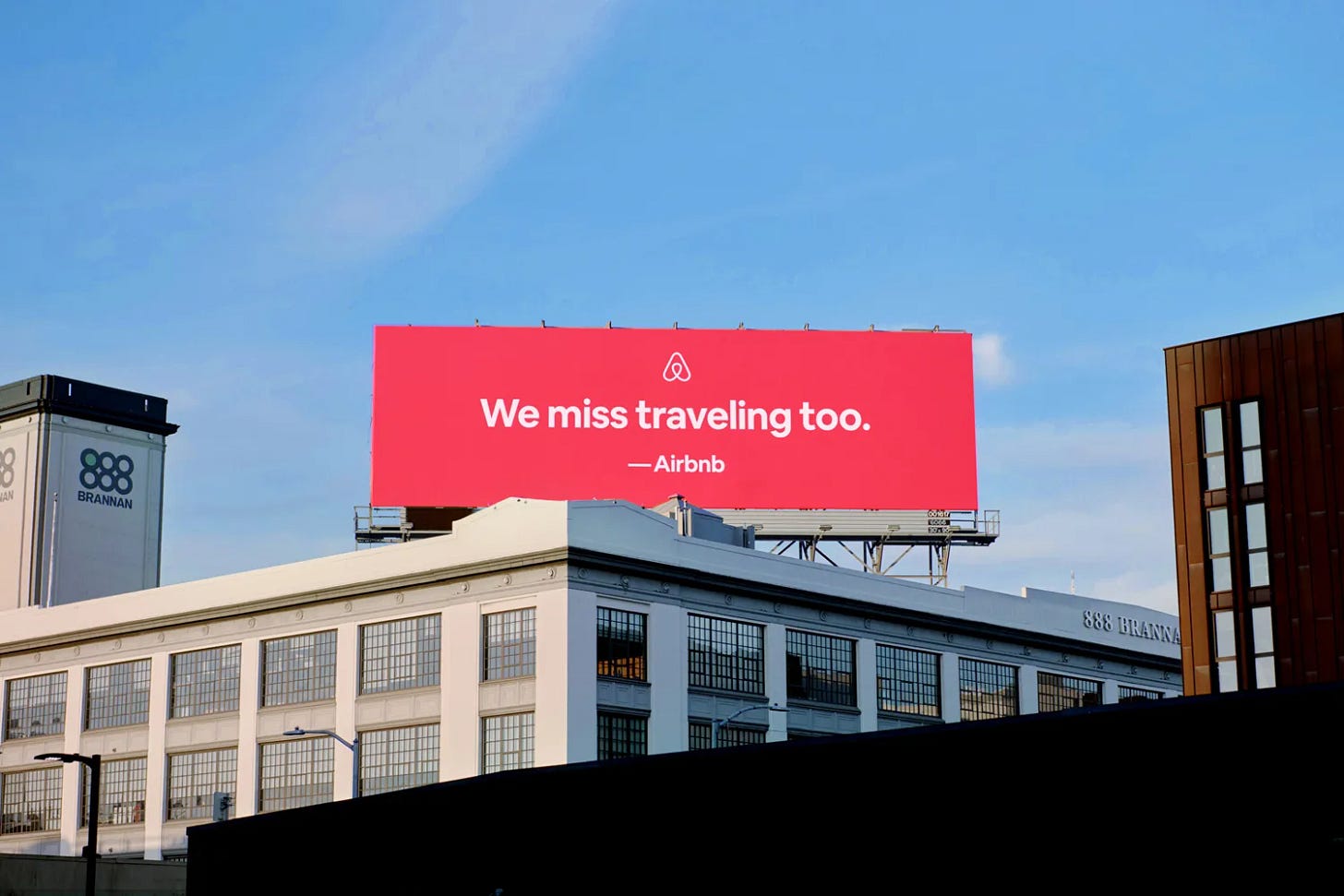

This point feels especially relevant given the ride the stock market has been on the last few months—but a well-diversified investment portfolio can weather volatility. In the same way, a strong brand gives you resilience during economic downturns (or maybe, like, a pandemic), protection against competitive pressure, and a buffer during industry disruptions or PR challenges.

How’s your brand’s “credit score”?

If you wanted one more great metaphor, then mental availability—how much space your brand occupies in consumers’ minds when making purchase decisions—functions like your brand’s credit score. A strong credit score doesn’t just make borrowing possible; it unlocks preferential rates and terms that create substantial long-term savings. A strong brand means the “credit bureau” in your customer’s minds is eager to offer “better terms” in the form of more attention and consideration.

When customers dedicate more mental space to your brand, you spend less to stay top-of-mind, face fewer objections during the buying process, and earn pricing flexibility that competitors can’t just easily match. Like a credit score, mental availability takes consistent investment and, sometimes, seemingly lower value work that the rating systems (i.e. the algorithm) overweight, to build. But it pays dividends through every subsequent customer interaction.

As your brand equity grows, customer trust increases, word-of-mouth referrals multiply, marketing efficiency improves, and premium pricing becomes possible. Your business becomes less volatile and more predictable—exactly what finance teams love most.

Yes, you still need to balance short and long-term marketing investments. Smart investors diversify between growth assets, near-term liquidity needs, and risk allocations, and your marketing portfolio still needs the same diversification.

The “annoying” thing with compound interest—whether financial or brand-related—is that dramatic results rarely materialize overnight. Maximum benefit requires patience and consistency. This patience deficit explains why so many companies fail to build brands that match their ambitions. They ask for immediate returns without the sustained investment, strategic care, and purposeful consistency it takes to earn meaningful brand equity.

The onus is on leadership to create shared understanding between finance, revenue, brand, and other marketing teams, rather than adversarial relationships. Invite your finance partners into the brand development process, try framing your narratives around these financial metaphors, and see how it goes. When both teams speak the same language, the compounding nature of your brand investments becomes so, so obvious. 💲

Thanks for reading.

Did this take resonate with you? If you liked what you read, consider:

saying hi or dropping a question in the comments!

connecting with me on LinkedIn: 👩🏼💻 Kira Klaas

sending to a friend 💌 or coworker 💬

Compounding interest will definitely be one of the best analogies for brand marketing. No doubt, businesses, startups, have defaulted to something they can track and measure which means end of funnel touch points. Sales and paid digital media are the activities of choice. Now, trust has eroded, people take longer to purchase, and.... paid digital media costs so much more!

I guess, once the ads stop working, or slow down, they start adding brand interest to the bank.

damn this is good Kira